All Categories

Featured

Table of Contents

If the house owner pays the passion and fines early, this will certainly minimize your return on the financial investment. And if the home owner declares personal bankruptcy, the tax lien certification will certainly be subordinate to the home loan and federal back tax obligations that are due, if any. An additional risk is that the worth of the household building could be much less than the quantity of back taxes owed, in which instance the home owner will have little motivation to pay them.

Tax obligation lien certifications are normally offered through public auctions (either online or face to face) performed yearly by area or local straining authorities. Available tax liens are generally published numerous weeks prior to the public auction, together with minimum bid amounts. Examine the internet sites of areas where you have an interest in buying tax obligation liens or call the area recorder's office for a listing of tax lien certificates to be auctioned.

Profit By Investing In Real Estate Tax Liens Pdf

Many tax obligation liens have an expiry date after which time your lienholder legal rights expire, so you'll require to relocate promptly to boost your possibilities of maximizing your investment return. Tax lien investing can be a rewarding method to buy realty, but success requires comprehensive study and due persistance

Firstrust has greater than a years of experience in providing funding for tax lien investing, together with a dedicated group of licensed tax obligation lien specialists who can help you leverage possible tax lien spending chances. Please call us to read more about tax obligation lien investing. FT - 643 - 20230118.

The tax obligation lien sale is the final action in the treasurer's initiatives to gather taxes on real estate. A tax lien is positioned on every county home owing tax obligations on January 1 every year and stays up until the real estate tax are paid. If the homeowner does not pay the residential or commercial property tax obligations by late October, the region markets the tax obligation lien at the yearly tax obligation lien sale.

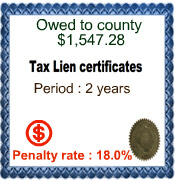

The investor that holds the lien will be notified every August of any kind of unpaid tax obligations and can support those taxes to their existing lien. The tax obligation lien sale permits exhausting authorities to get their budgeted profits without having to wait for delinquent tax obligations to be gathered. It additionally supplies a financial investment opportunity for the general public, members of which can buy tax lien certificates that can potentially make an eye-catching rates of interest.

When retrieving a tax obligation lien, the homeowner pays the the delinquent taxes along with the overdue passion that has built up against the lien since it was cost tax sale, this is credited to the tax lien holder. Please call the Jefferson Region Treasurer 303-271-8330 to acquire payoff details.

Tax Lien And Tax Deed Investing

Home ends up being tax-defaulted land if the home tax obligations continue to be overdue at 12:01 a.m. on July 1st. Property that has ended up being tax-defaulted after 5 years (or three years when it comes to building that is additionally based on a nuisance reduction lien) becomes subject to the region tax obligation enthusiast's power to offer in order to satisfy the defaulted real estate tax.

The area tax obligation collector may supply the home up for sale at public auction, a secured bid sale, or a bargained sale to a public company or qualified nonprofit organization. Public auctions are the most common means of marketing tax-defaulted property. The auction is carried out by the region tax obligation collection agency, and the residential property is marketed to the highest possible bidder.

Secret Takeaways Browsing the globe of realty financial investment can be complicated, however understanding various investment opportunities, like, is well worth the job. If you're aiming to diversify your profile, buying tax liens could be an alternative worth checking out. This guide is created to help you recognize the fundamentals of the tax obligation lien financial investment approach, assisting you through its process and aiding you make informed decisions.

A tax lien is a lawful case enforced by a federal government entity on a building when the proprietor stops working to pay real estate tax. It's a method for the federal government to make certain that it collects the needed tax obligation earnings. Tax obligation liens are affixed to the home, not the individual, meaning the lien sticks with the building no matter ownership modifications until the debt is removed.

How To Invest In Tax Liens Online

Tax lien investing is a kind of actual estate financial investment that entails purchasing these liens from the federal government. When you invest in a tax lien, you're basically paying somebody else's tax obligation financial debt.

As a capitalist, you can purchase these liens, paying the owed taxes. In return, you get the right to collect the tax obligation financial debt plus rate of interest from the home owner.

It's vital to thoroughly evaluate these prior to diving in. Tax obligation lien certificate investing offers a much lower resources requirement when contrasted to various other types of investingit's possible to delve into this possession course for as low as a couple hundred bucks. Among the most substantial attracts of tax lien investing is the possibility for high returns.

Sometimes, if the building proprietor falls short to pay the tax financial obligation, the financier may have the opportunity to seize on the residential property. This can potentially lead to obtaining a home at a fraction of its market value. A tax obligation lien typically takes concern over other liens or home loans.

This is because, as the first lien owner, you will certainly be required to acquire any type of succeeding liens. (New tax obligation liens take priority over old liens; unfortunate however real.) Tax lien spending involves browsing lawful treatments, specifically if repossession ends up being necessary. This can be difficult and may require legal support. Redemption Durations: Residential property proprietors generally have a redemption period during which they can pay off the tax obligation financial debt and rate of interest.

Affordable Auctions: Tax lien public auctions can be very affordable, specifically for residential properties in preferable locations. This competitors can drive up prices and possibly decrease overall returns.

Real Estate Investing Tax Lien Certificates

While these processes are not complicated, they can be shocking to brand-new capitalists. If you are interested in getting going, assess the following steps to acquiring tax liens: Start by informing on your own about tax obligation liens and how actual estate public auctions work. Understanding the lawful and monetary complexities of tax lien investing is vital for success.

Latest Posts

Tax Lien Investing Illinois

Is Buying Tax Lien Certificates A Good Investment

Buying Tax Liens For Investment